Content

The statement of stockholders’ equity is usually prepared for the board members, and they use it to keep track of what has happened with their shareholders’ equity. Most public companies also provide a copy of this report to their shareholders.

- Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

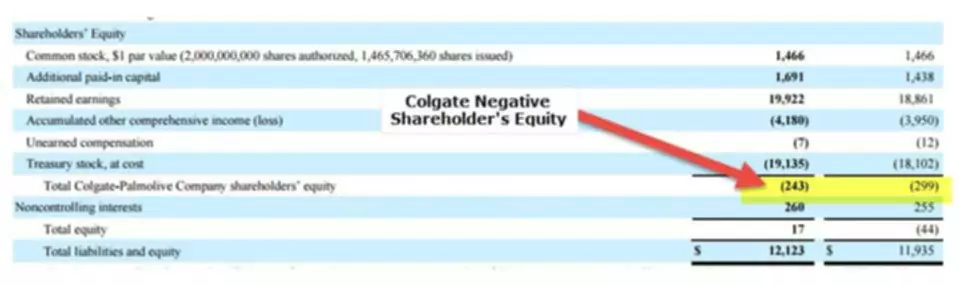

- When a company buys shares from its shareholders and doesn’t retire them, it holds them as treasury shares in a treasury stock account, which is subtracted from its total equity.

- After this date, the share would trade without the right of the shareholder to receive its dividend.

- Perhaps the timeline/checklist will indicate that JE33 must be submitted by the accounts payable clerk six days after each month ends.

- Under the indirect method, the first amount shown is the corporation’s net income from the income statement.

- Go to the section of the 10-K which presents the corporation’s financial statements and view the statement of stockholders’ equity.

- The report provides additional information to readers of the financial statements regarding equity-related activity during a reporting period.

Other comprehensive income includes certain gains and losses excluded from net earnings under GAAP, which consists primarily of foreign currency translation adjustments. However, companies will sometimes choose to keep some of the profits as retained earnings. However, in the initial public offering, the money goes to the company, and this money is share capital. Stockholder equity is essentially the value of a stock issuing company that belongs to its shareholders. Profit and loss statements and cash flow provide an understanding of how money flows in and out of a business. However, shareholders’ equity alone may not provide a complete assessment of a company’s financial health. 1.) The business makes a profit and therefore the change increases the reported retained earnings.

What is Statement of Shareholders’ Equity Used For?

If used in conjunction with other tools and metrics, the investor can accurately analyze the health of an organization. Business owners can create a physical shareholder statement of equity to go into the balance sheet, using Excel, a template oraccounting softwarethat automates a lot of the work. The statement of shareholder equity is also important in trying times. It can also reveal whether you have enough equity in the business to get through a downturn, such as the one resulting from the COVID-19 pandemic. The statement of shareholder equity shows whether you are on sound enough footing to borrow from a bank, if there’s value in selling the business and whether it makes sense for investors to contribute. IAS 1 requires a business entity to present a separate statement of changes in equity as one of the components of financial statements. In the United States this is called a statement of retained earnings and it is required under the U.S.

For any of the financial statements to be accurate it is necessary to have a proper cut-off. This means including all of a company’s business transactions in the statement of stockholders equity proper accounting period. For example, the electricity bill arriving on January 10 might be the cost of the electricity that was actually used in December.

The Importance of the Face Value of Shares

This is usually one of the last steps in forecasting the balance sheet items. Below is an example screenshot of a financial model where you can see the shareholders equity line completed on the balance sheet. Share Capital refers to amounts received by the reporting company from transactions with shareholders. Companies can generally issue either common shares or preferred shares. Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

Unrealized gains and losses are the changes in the value of an investment that has not yet been sold for either a profit or loss. Treasury stock includes stock that a company has bought back from investors. To find the equity of a company, all of its assets are added together, and then its liabilities are subtracted. However, this does not provide business owners and investors a complete understanding of how the business’s value is being affected.

What is Statement of Shareholders’ Equity?

Multi-year balance sheets help in the assessment of how a company is performing from one year to the next. In the example, this company had experienced a significant year-over-year increase in total assets, from $675,000 to $770,000. However, this change was offset by a substantial increase in total liabilities, from $380,000 to $481,000. Since total assets rose $95,000 versus a $101,000 increase in total liabilities over the period, the company’s stockholders’ equity account actually dropped in value by $6,000. Here is an example of how to prepare a statement of stockholder’s equity from our unadjusted trial balance and financial statements used in the accounting cycle examples for Paul’s Guitar Shop. First, the beginning equity is reported followed by any new investments from shareholders along with net income for the year. Second all dividends and net losses are subtracted from the equity balance giving you the ending equity balance for the accounting period.

When a business does this it changes the ratio of outstanding shares to the profits of the business and in turn when the business reduces the number of shares outstanding the earnings per share will increase. Another reason for a business buy back stock is to issue that stock to managers and executives as a form of stock-based compensation. The cash outflows spent to purchase noncurrent assets are reported as negative amounts since the payments have an unfavorable effect on the corporation’s cash balance. A common outflow is connected to a corporation’s capital expenditures. This is the property, plant and equipment that will be used in the business and was acquired during the accounting period. Since equity accounts for total assets and total liabilities, cash and cash equivalents would only represent a small piece of a company’s financial picture. Companies may return a portion of stockholders’ equity back to stockholders when unable to adequately allocate equity capital in ways that produce desired profits.

Balance sheets are displayed in one of two formats, two columns or one column. With the two-column format, the left column itemizes the company’s assets, and the right column shows its liabilities and owner’s equity. A one-column balance sheet lists the company’s assets on top of its liabilities and owner’s equity. In both cases, the resulting stockholders’ equity is at the bottom. • Stock Splits- much like the name implies stock splits refer to a split in the value of the stock by increasing the number of shares outstanding. This means that the stockholder still owns the same dollar amount of value in the company but now the stock price has been cut in half and the shareholder owns twice as many shares as before. 1.) The business pays dividends to the shareholders therefore decreasing the retained earnings that are reported.

5 financial statements used by business entities under U.S. GAAP are:

1) Balance sheet

2) Income statement

3) Statement of cash flows

4) Statement of comprehensive income

5) Statement of changes in stockholders’ equity #Accounting #CMA #exams— CMATrainer.com (@theCMAtrainer) January 30, 2020

A report called ‘statement of retained earnings is maintained to present the changes in the retained earnings for the financial period. It starts with the accumulated retained earnings balance of the last period, adds the net income/loss to it, and then subtracts the cash or stock dividend payouts from it. A statement of stockholder equity is a section in the balance sheet that accounts for the value of equity from the beginning to the end of the accounting period. The stockholders’ equity is only applicable to corporations who sell shares on the stock market. For sole traders and partnerships, the corresponding concepts are the owner’s equity and partners’ equity. This formula takes into consideration the capital that was paid for shares, added to the retained earnings minus the treasury shares, which the company had previously issued, but repurchased. Share capital is the amount of money invested in a company by shareholders to grow the company.